FAQs

- Home

- FAQs

Frequently Asked Questions

Find answers to all your queries about our services.

Sales

Legal

Finance

Documentation

Research

HR

IT

What is the Colombo Stock Exchange ?

The Colombo Stock Exchange (CSE) operates the only share market in Sri Lanka and is responsible for providing a transparent and regulated environment where companies and investors can come together. The CSE is a company that is limited by guarantee established under the Laws of Sri Lanka. The CSE is licensed by the Securities and Exchange Commission of Sri Lanka (SEC) and is a mutual exchange consisting of 15 Members and 14 Trading Members.

All Members and Trading Members are licensed by the SEC to operate as Stockbrokers. At present the CSE functions as a market operator and through its fully owned subsidiary, Central Depository Systems (Pvt.) Limited (CDS), acts as a clearing and settlement system facilitator. The CSE also oversees compliance through a set of rules, promotes standards of corporate governance among listed companies and is actively involved in educating investors. In the course of its operations, the CSE interacts with many customers and stakeholders which include issuers (such as companies, corporations and unit trusts), commercial banks, investment banks, fund managers, stockbrokers, financial advisors, market data vendors and investors.

What are the CSE trading times ?

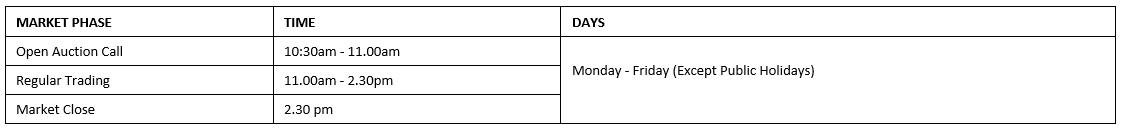

The Exchange is open for continuous trading from Monday to Friday from 11.00 am to 2.30 pm. The trading sessions are as follows:

Open Auction Call

During open auction call, the system accepts orders. These orders can be amended and cancelled during the session. However, no trades take place during this stage. Orders during this period are held in the Automated Trading System (ATS) and will be forwarded to the execution engine at Regular Trading session. At 10.30 am the system starts matching orders according to the algorithm. It establishes the opening price and determines the orders to be executed according to the rules for the open call session (Automated Trading Rule 4).

Regular Trading

During regular trading (11.00am - 2.30pm) new orders are continually matched to existing orders in the order book. If an order cannot be executed, it is stored in the order book.

Market Halt

In the event the S&P SL20 Index drops by 5% within the day from the previous market day's close, a 'Market Halt' will be imposed on all equity securities for a period of 30 minutes. In case the above scenario takes place at 2.00 pm or later, the market will be halted and closed at 2.30 pm. Market wide index-based circuit breakers are imposed by stock exchanges to halt trading of equity securities to provide a 'cooling off' period when there is unusual movement in the index. Broker firms may cancel any pending orders during the 'market halt'. However, the broker firms cannot enter new orders or amend pending orders during the 'market halt'.

What are the listing boards on the CSE ?

Equity securities of a public company can be listed on either the Main or Diri Savi Board of the CSE. The Main Board consists of companies which have a larger capital base while medium to small companies and start-up companies are listed on the Diri Savi Board.

What are the price indices on CSE ?

The CSE has two main price indices, the All Share Price Index (ASPI) and the S&P Sri Lanka 20 Index (S&P SL 20). These index values are calculated on an ongoing basis during the trading session, with the closing values published at the end of each session. ASPI is a market capitalization weighted index of all companies listed in the CSE. The base value is established with average market value as of the year 1985. S&P SL20 Index is market capitalization weighted and provides liquid exposure as it covers the most liquid stocks from the CSE.

Additionally, the Total Return Indices (TRI) are calculated to tracks the market performance on a Total Returns basis. The TRI exceeds the scope of existing price indices (ASPI and S&P SL20) and incorporates dividends into its computation. CSE publishes TRI based on the ASPI and S&P SL20. Price indices and TRI are also calculated for each of the 20 business sectors based on the ASPI.

What is the composition of the market/transaction fees ?

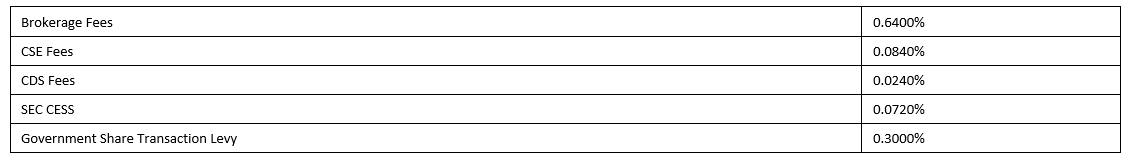

Transaction cost applicable for equity and debt securities is given below:

Transactions up to LKR 100 million - 1.12%

Divided as follows:

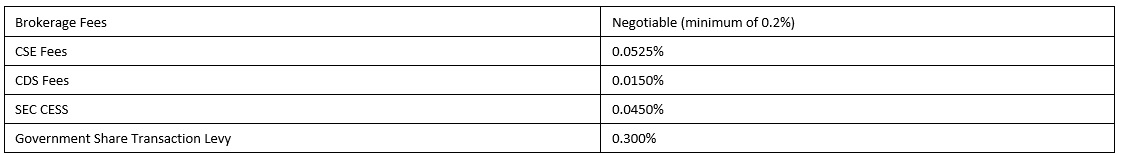

Transactions over LKR 100 million - Step up basis

Divided as follows:

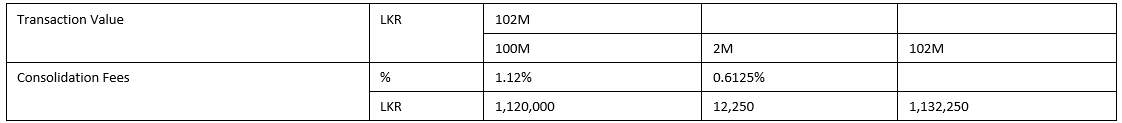

For example, as seen below, for a transaction of LKR 102Mn, the transaction cost of 1.12% will be applicable for the first Rs. 100 million and 0.6125% will be applicable for the balance amount.

The CSE trading records will indicate the brokerage as zero for transactions over LKR 10 million. The broker firms are expected to insert 0.2% or a higher percentage which is negotiated with the client as the brokerage before printing the Bought/Sold Notes.

How do i receive dividends and what do i do with it ?

The dividends can be directly remitted to your local bank/SIA account.

Are there any taxes applicable apart from the transaction costs ?

A withholding tax of 10% is applicable for dividend income. Currently there are no capital gains tax.

What are the laws and regulations that I must be aware of?

While SEC Act No. 19 of 2021 primarily govern the Capital Market industry, the Rules and Regulations designed specifically under the purview of SEC Act are in (including but not limited to) Trading Participant Rules, CDS Rules, Listing Rules etc.

How do I make a complaint with regards to my Service Provider (RIA/Agent)?

You can simply send an email to anne@bartleetreligare.com (Compliance Officer) detailing your concerns/complaints. Then the necessary steps will be taken to resolve your complaint. If you believe the feedback provided by the Officer is not sufficient then you can consider submitting a formal complaint with the CSE.

How do I change my RIA/Agent if the services that are provided are not satisfactory?

You can make a formal complaint to the Compliance Officer and explain your situation and then the Officer will discuss it with the team and assign a different RIA according to your preference.

How do I terminate an account held with a different broker firm?

You can simply send an email/letter to the Compliance Officer of the previous Broker and simply explain the situation and register with BRS through the CSE Mobile APP. You can further transfer the shares in your previous account via CSE Mobile App with the help of our documentation team.

What is the role of the Finance Division

The Finance Division plays a crucial role in managing the financial aspects of the firm, including accounting, financial planning, and reporting and compliance on regulations related to finance operations.

What are the brokerage fees and charges for trading services?

Please refer to our fee schedule for detailed information.

Up to Rs. 100Mn

Brokerage Fees - 0.640%

CSE Fees - 0.084%

CDS Fees - 0.024%

SEC Cess - 0.072%

Share Transaction Levy - 0.300%

Above Rs. 100Mn

Minimum brokerage(floor) - 0.200%

CSE Fees - 0.0525%

CDS Fees - 0.0150%

SEC Cess - 0.0450%

Share Transaction Levy - 0.300%

How can I deposit funds into my trading account?

We offer various methods for depositing funds, including bank transfers, online payment, and cheques. You can deposit Money to our Bank account 1415792301 maintained at Foreign Branch of Commercial Bank of Ceylon PLC.

What is the process for withdrawing funds from my trading account?

To withdraw funds, you can submit a withdrawal request through your trading account portal or via email to Investment Advisor and then our Finance Division will process it in accordance with our withdrawal policy.

What is the settlement rule?

Settlement for shares purchased need to be settled on T+3day and for the sale of shares the finance division will settle to you on T+3day.

What is an inter-account fund transfer?

An inter-account fund transfer is the process of moving money from one account to another related account and the inter account fund transfers are subject to regulatory clearances with relevant documents.

Is it possible to keep sales proceeds in Trading Account?

Yes. You can keep money in Trading Account by submitting a Sales Proceeds holding letter to Finance Division.

What is the Credit Extending Service facility, and how does it work?

Credit Extension allows you to trade with borrowed funds after submitting a Credit Agreement. We provide credit facility services at a reasonable interest rate based on your paid portfolio, and the details can be found through your Investment Advisor and by contacting our Finance Division.

Can you explain the tax implications of stock trading and investments?

While we can provide general information, it's essential to consult a tax professional for personalized advice regarding your tax obligations related to stock trading and investments.

How do you ensure the security of my financial information and assets?

We employ robust security measures to protect your financial information and assets. These include encryption, two-factor authentication, and regular security audits.

How can I get assistance with tax documentation related to my trades?

Our Finance Division can assist you in generating the necessary statements such as Statement of Account and Statement of Portfolio for your trades.

What are the regulatory requirements and compliance standards your firm follows?

We adhere to all relevant financial regulations and compliance standards, including those set by regulatory authorities. Our Finance Division monitors and ensures compliance with these requirements.

How can I update my bank account details with your firm?

You can update your information through CSE Mobile app or by contacting our Documentation Division for assistance on submitting KYC Documents.

What should I do in case of financial emergencies?

In case of emergencies, please contact your Investment Advisor or the Finance Division for immediate assistance.

What is the minimum age to create a CDS Account?

Any person who has completed 18 years of Age is eligible to open a CDS Account.

How do I open a CDS Account?

You can Proceed to the BRS Website and simply follow the guidelines provided therein. https://www.bartleetreligare.com/invest-now/

How do I transfer some of my shares or my entire portfolio that I carry with a different broker to my BRS account?

How do I change/Edit certain personal details entered in my CDS Account? For Example- Address, Bank Account Number, Email Address, Telephone Number etc.

In order to start my trading journey how much should I invest as an initial investment?

This is entirely dependent on your individual financial position.

If I am not aware of the Agent/RIA who has been assigned to handle my CDS Account how can I obtain information in this regard?

You can immediately contact 011522200 and get in touch with any such assistance.

How can I access research reports published by BRS?

Research reports are available in the website’s research portal. Further, if you want to receive reports via email please contact your investment advisor.

What types of research reports are available in the portal?

In addition to the periodical reports (Morning Shout, Daily, Weekly, Monthly) we publish Initiations, Earnings Reviews, Sector Reports, Company Information Notes, IPO Notes, Factsheets, Economic Updates and Special Reports (Stock/Event or Market updates).

What is the application process for a job at Bartleet Religare?

You can find our current job openings on our Careers page. Click on the job listing you're interested in, and you'll see instructions on how to apply.

What qualifications and skills are required to work at Bartleet Religare?

The specific qualifications and skills required vary by job position. You can find detailed requirements in each job posting on our Careers page.

How can I submit my resume or application?

To apply for a job, you can upload your resume and complete the application form on our Careers page, or you can email your CV to the given email address on our Careers page.

Can I submit a general application for future job openings?

We encourage you to apply for specific job openings. However, you can also join our talent network or subscribe to job alerts on our Careers page to stay updated on future opportunities.

What is the interview process at Bartleet Religare?

Our interview process typically includes initial screening interviews, technical assessments (if applicable), and in-person interviews. Specific details will be provided to candidates during the application process.

How can I check the status of my job application?

We appreciate your interest in joining our team. After the application deadline, we carefully review all submitted CVs. If your CV is selected for further consideration, you can expect to hear from us within one week. However, if you do not receive any communication from our team during this period, it indicates that your application did not progress to the next stage. If you have any specific inquiries regarding your application, please feel free to reach out to our HR Manager, Upul, at upul@bartleetreligare.com.

What benefits are offered to employees at BRS?

We offer a competitive benefits package, including health insurance, retirement plans, paid time off, and more. Details of our benefits are provided during the onboarding process.

How often are performance reviews conducted?

Performance reviews are typically conducted on an annual basis, but the frequency may vary by department. Your supervisor will provide more information.

What should I do if I have a workplace concern or issue?

If you have a workplace concern, please reach out to your supervisor or HR representative. We have a confidential reporting process in place to address any issues.

How does the onboarding process work for new hires?

New hires will go through an orientation program that includes training, paperwork completion, and an introduction to company policies and culture. HR will guide you through the onboarding process.

Can I participate in professional development and training programs at Bartleet Religare Sec. ?

Yes, we encourage professional development and offer training programs to help employees enhance their skills and grow in their careers.

How do I update my personal information, such as contact details or emergency contacts?

You can update your personal information through the HR portal or by contacting HR directly.

How to open an Online Trading Account?

You can download Online Trading Application from our website. Send duly filled application to your investment advisor. After our verification process, you will receive login details via email.

How to reset Online Trading Account password?

Using “Forgot Password” option yourself can reset your password instantly. Otherwise have to send passwords reset request email to your investment advisor.

Why was my online trading account locked?

If you try to login to account with incorrect password Three times, your account gets LOCKED automatically. To UNLOCK the account, you must contact your investment advisor or IT division.

Why not allow me to BUY/SELL from my online trading account?

There could be a restriction from our end or CSE side. Need to contact your investment advisor to get it clarified or/and resolve the issue.

How to join a few CDS accounts to one online trading login?

All accounts need to have an online trading facility obtained. There is a form called “Join declaration” which requires to join the accounts for access from one login.

How to change my email address?

There is service called “e-connect” in CSE mobile application which enables you to change some of your information. Relevant changes synchronize with our system also.

How to increase my buying power?

You have to check with your investment advisor to find possible options.

Why am I not getting statements email?

There could be a few reasons for that. We are sending statements emails to email address you have registered with. Make sure check the same email account for statements. If it’s not in the email INBOX, please check in the JUNK/SPAM folders as well. If all above conditions are met, but still not getting our emails, have to check with IT department.

What should I do if I feel my online trading account access is exposed?

Immediately change your account password if possible. If not contact your investment advisor or BRS IT division.